Best Travel Credit Cards: Travellers have multiple options of credit cards, starting from flight-related advantages to the lounge facility and then the discounts on hotel bookings, dining and little extra transaction facilities.

As the travel industry and multiple countries are open to travelling, we at TRAVEL WITH THOUSIF have sorted out some of India’s best travel credit cards for the year 2022.

Table of Contents

Best Travel Credit Cards

Here is the list of best travel credit cards in India for 2022:

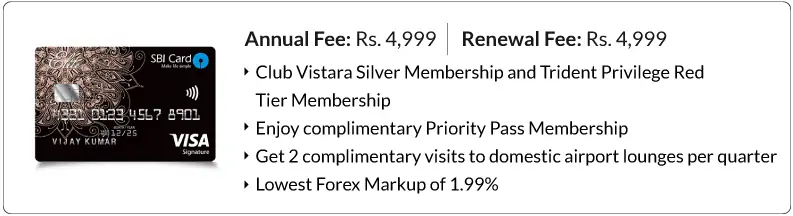

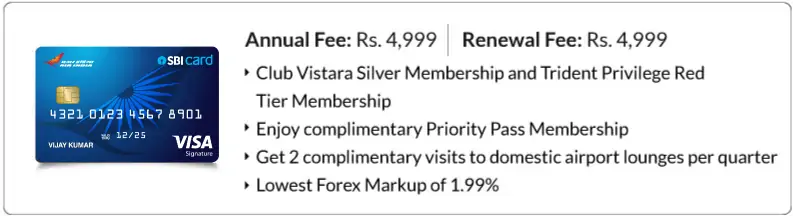

SBI Card ELITE

The SBI Elite Card is a multi-purpose card that offers rewards in travel, shopping, and movies.

We have included this card in our list of the best travel credit cards since it can help you save money on your travel bills, even though the card has an annual cost of Rs. 4,999, it comes with Rs. 5,000 in welcome rewards that can be used for Yatra travel vouchers.

The card also comes with a complimentary Silver membership to Club Vistara, which gives you access to flight upgrades and other Vistara Airlines perks.

In addition, the card entitles you to be complimentary international (Priority Pass) and domestic (Visa/Mastercard) lounge visits.

The card also comes with hotel privileges, but only at Trident Hotels. In addition, the card offers a 10% discount on top of a 2.50% rewards rate, i.e. 10 points per Rs. 100, with 1 point equaling Rs. 0.25.

If you want to use your card internationally, you can save a lot of money on the FX markup because SBI Elite costs only 1.99%, compared to 3.5% or more for the regular markup.

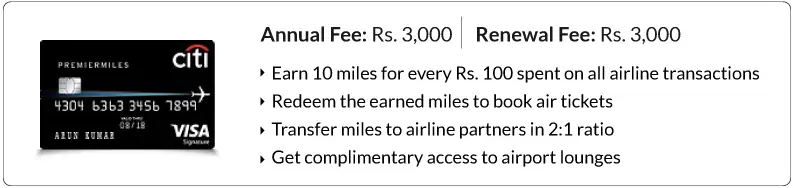

Citi PremierMiles Credit Card

The Citi PremierMiles Credit Card is a travel credit card designed for regular flyers to earn air miles.

The most excellent aspect about this card is that the miles you earn can be used on various airlines, unlike popular co-branded cards that only offer perks with one.

Earned air miles also never expire, so you may keep earning miles and redeeming them whenever you want.

It provides you with 10,000 miles as a welcome bonus. Because the monetary value of these miles is Rs. 4,500, this benefit is comparable to the Rs. 3,000 membership cost.

In addition, if you pay the renewal price, you will receive 3,000 free miles per year.

However, if you want to save money on overseas expenses, this card is not the best option because the foreign exchange markup is very expensive (3.5%), and the card does not include access to international airport lounges.

Overall, Citi PremierMiles is a true-blue travel card that lacks dining, retail, and entertainment advantages.

However, if you frequently travel within the country and want to save money on flights, this card is the best option for you.

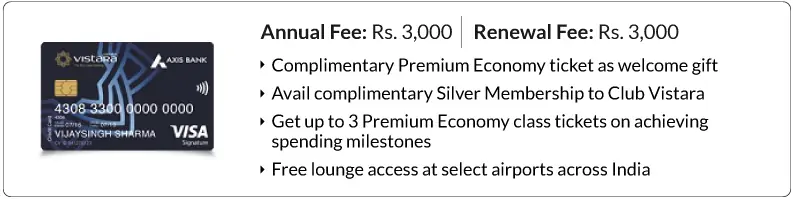

Axis Bank Vistara Signature Credit Card

The Axis Bank Vistara Signature Credit Card is designed for frequent travellers who fly with Vistara Airlines.

It offers up to 2% Club Vistara Points, redeemed for free flights or airline upgrades. As the card’s milestone perks are outstanding, the more you spend on it, the more travel rewards you will receive.

By achieving spending milestones, you can earn up to four premium economy tickets every year.

In addition, long-distance flights will earn more awards than short-distance trips.

In addition, you can take advantage of Club Vistara Silver Membership, Travel Insurance Protection, and Golf Discounts.

Vistara Signature Card hence beats Axis Vistara Platinum Credit Card in terms of benefits.

If you frequently fly with Vistara Airlines, you should obtain this card.

MakeMyTrip ICICI Bank Signature Credit Card

The MMT ICICI Bank Signature Credit Card is an excellent choice for frequent travellers who do not want to sacrifice comfort.

The card comes with exclusive MakeMyTrip incentives, including a welcome voucher and attractive reward plans.

All rewards are credited to your MMT account as My Cash, each 1 My Cash earned on this card equaling Rs: 1.

These points can be used to book hotels, plane tickets, or taxis on MMT.

Overall, the ICICI MMT Signature Credit Card is a good choice for travellers looking to save money on their travel expenses.

However, keep in mind that the benefits of this card are heavily geared toward MakeMyTrip, so if you rely solely on MMT to plan your vacations, this card may be the best travel credit card for you.

Air India SBI Signature Credit Card

The SBI Air India Signature Credit Card is India’s most significant travel credit card, especially for Air India Loyalists. However, because the base reward rate is 4%, it must be in your pocket if you spend a lot on your credit card.

Each point is worth the same amount of Air India Miles.

If you spend Rs. 20 lakh in a year, you will receive 1 lakh rewards, which are comparable to 1 lakh Air India Miles and can be used to book free trips several times.

Another advantage of rewards points is that they may be redeemed for anything other than air miles; you can use them to get services from the rewards catalogue.

However, because this is a co-branded card, all of the benefits are exclusive to Air India.

If you are unsure if you want to fly with Air India for most of your trips, other options include the American Express Platinum Travel Credit Card, MakeMyTrip ICICI Bank Signature Credit Card, and YES FIRST Preferred Credit Card.

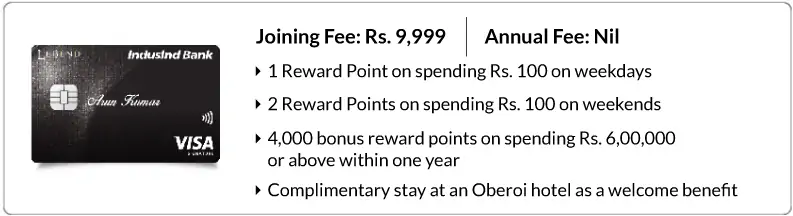

IndusInd Bank Legend Credit Card

The IndusInd Bank Legend Credit Card is a low-cost credit card with specific incentives for regular travellers.

With the IndusInd Bank Legend Credit Card, you can get discounts from Yatra, Oberoi Hotels, and BookMyShow.

Aside from that, the card offers a low 1.8% foreign currency markup. Moreover, with a priority pass membership, you will get access to more than 600 lounges all over the world.

In addition, the card comes with an Rs: 25 lakh aviation accident insurance policy.

HDFC Regalia Credit Card

The HDFC Regalia Credit Card is one of the best in India. It is excellent for people who spend a lot of money and travel a lot.

If you frequently travel with Regalia, you will receive six international and twelve domestic lounge visits per year.

Moreover, only frequent international travellers are charged a minimal foreign exchange markup fee of 2% with this card.

The forex markup cost is usually 3.5% or greater, with only a few cards charging a lower amount.

One of them is HDFC Regalia. Additionally, you will receive hefty bonus prizes when you accomplish certain spending milestones.

This card comes with an extended range of features and benefits compared to any other credit card issued by any Indian bank and minimal annual/renewal costs waived on a spending basis.

It has a default reward rate of 2.67%, which is fantastic, and you will not find such a rate with most other banks. However, the redemption rate is merely 0.5%.

So, if you spend Rs. 15,000, you will gain 400 reward points, which are worth Rs. 200 when redeemed.

If you are a frequent shopper who also travels several times a year, this card is ideal for you.

Get our best stuff sent straight to you! Join our WhatsApp Channel.